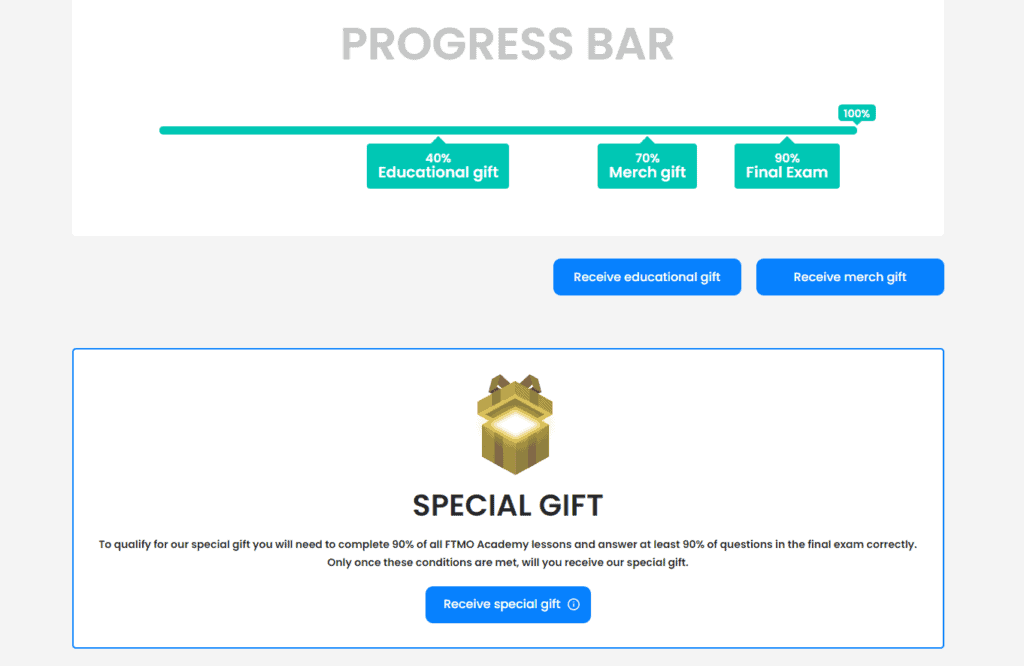

The following is FTMO academy Answers of their training program.

Please note that the information below is for informational purposes only. Try your hand at the course before continuing.

There is a lot of useful information that FTMO has to offer in the course.

Use Ctrl + F to find the answer faster.

I. Putting it all together

01. How to build a robust trading strategy

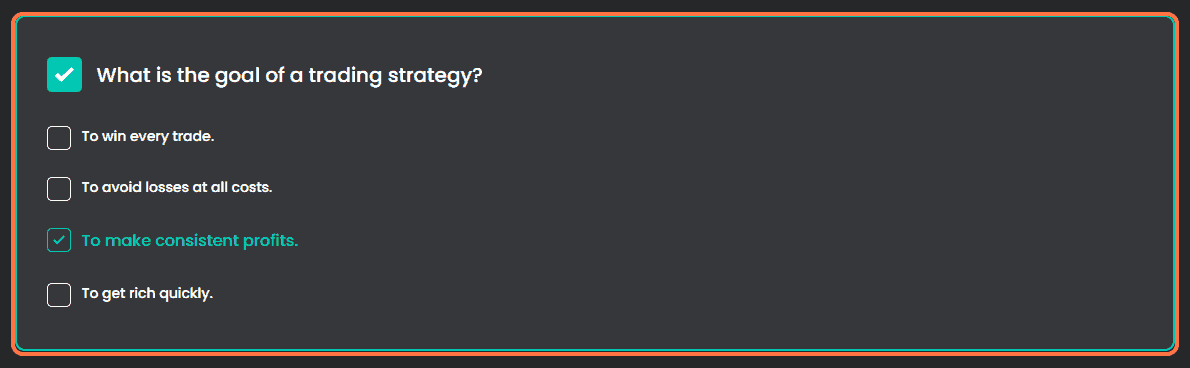

1. What is the goal of a trading strategy?

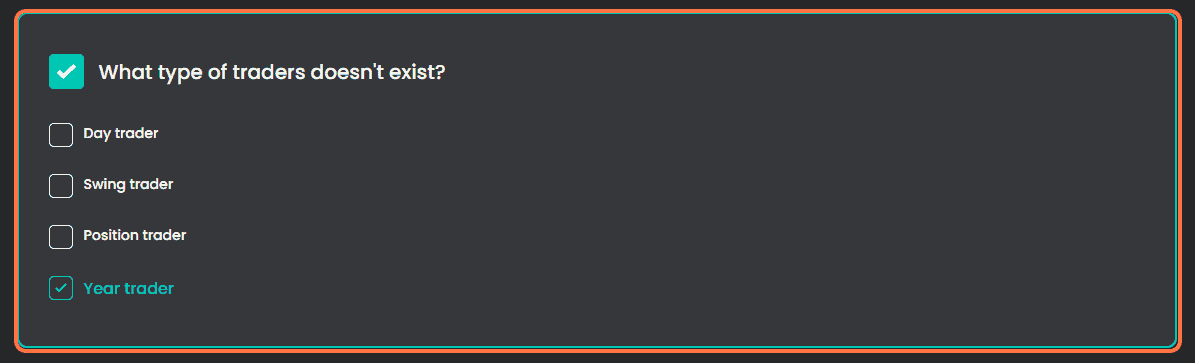

2. What type of traders doesn’t exist?

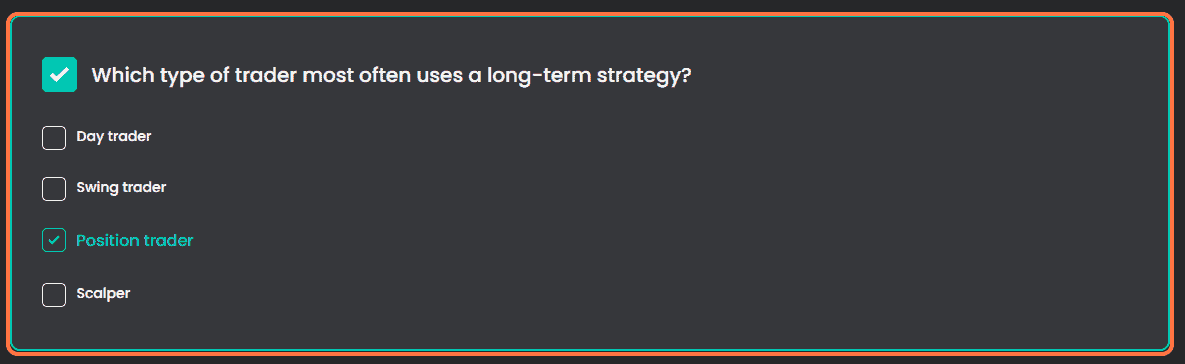

3. Which type of trader most often uses a long-term strategy?

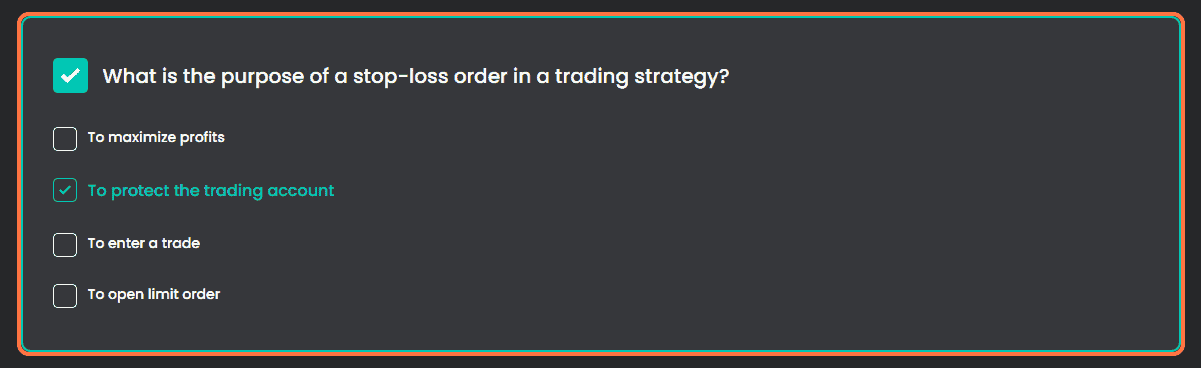

4. What is the purpose of a stop-loss order in a trading strategy?

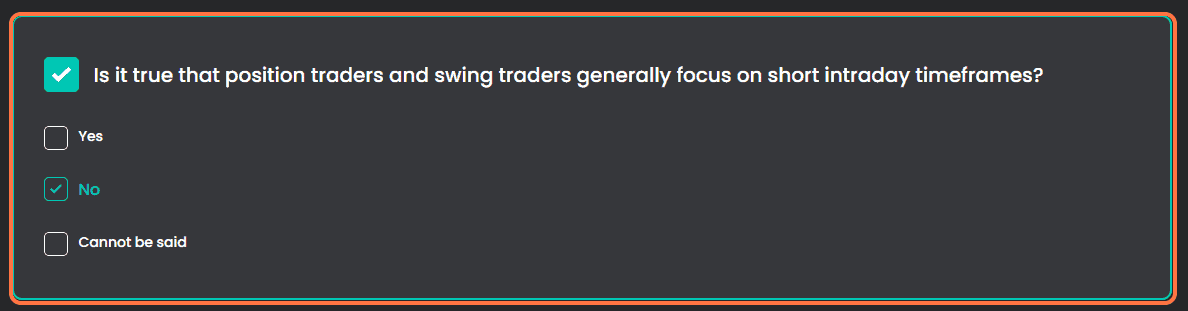

5. Is it true that position traders and swing traders generally focus on short intraday timeframes?

6. If you don’t have enough time during the day, what type of a trading strategy would be suitable to use?

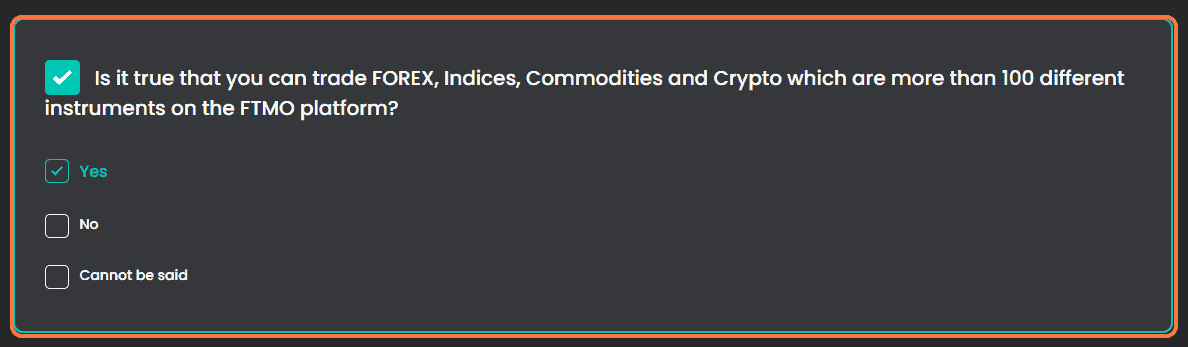

7. Is it true that you can trade FOREX, Indices, Commodities and Crypto which are more than 100 different instruments on the FTMO platform?

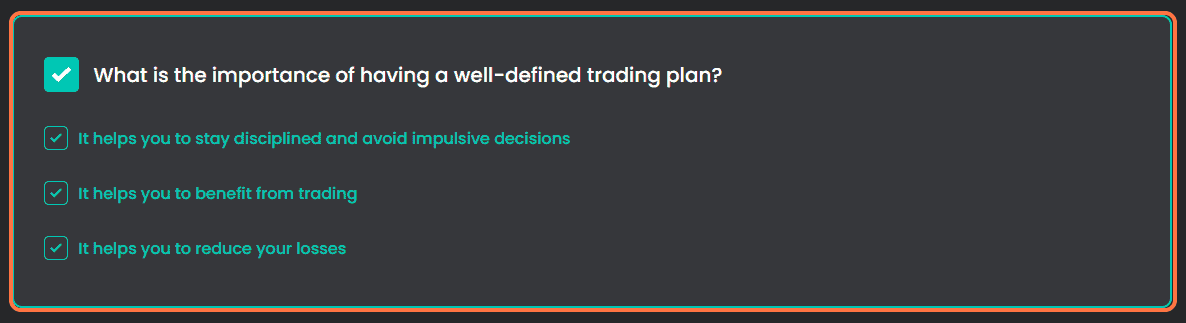

8. What is the importance of having a well-defined trading plan?

02. Risk Managerment

1. What is the primary goal of risk management in trading?

2. What is the primary benefit of diversifying a trading portfolio?

3. What is the Reward:Risk ratio?

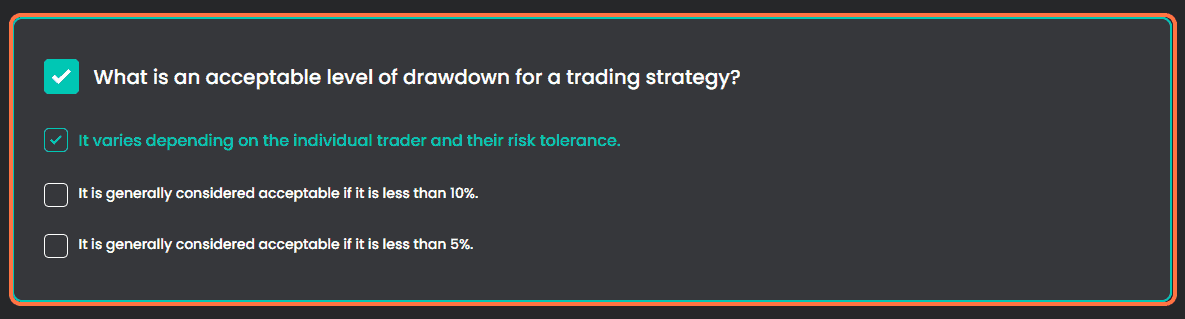

4. What is an acceptable level of drawdown for a trading strategy?

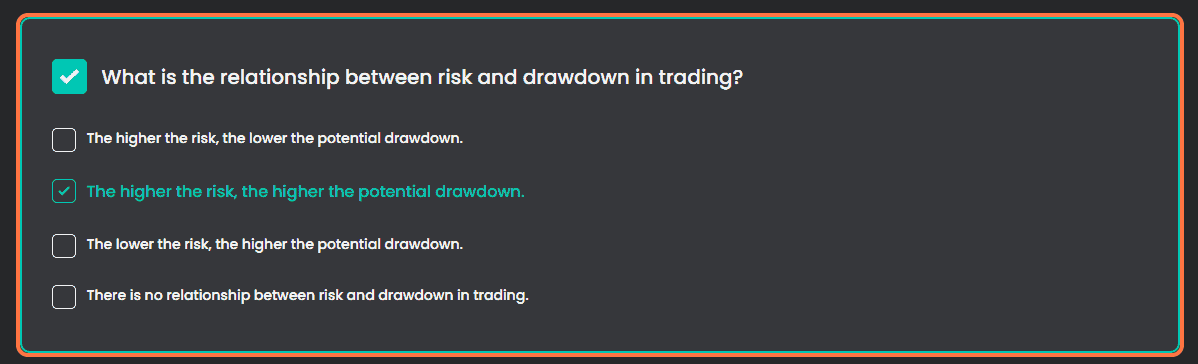

5. What is the relationship between risk and drawdown in trading?

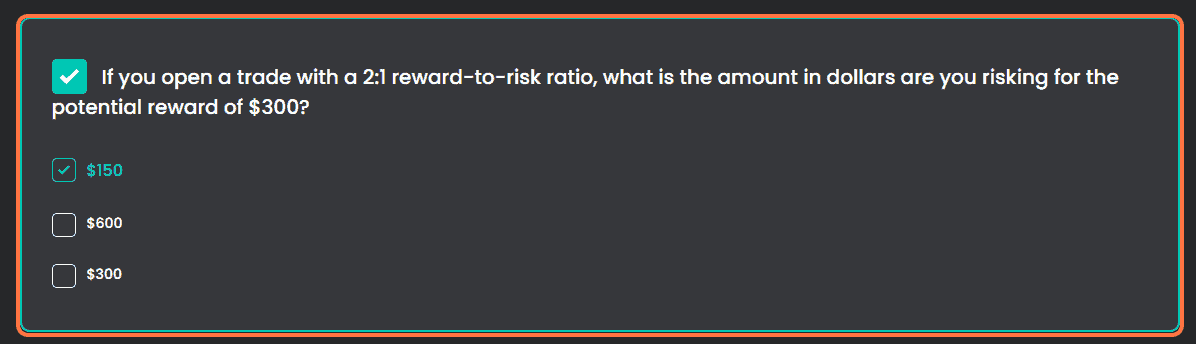

6. If you open a trade with a 2:1 reward-to-risk ratio, what is the amount in dollars are you risking for the potential reward of $300?

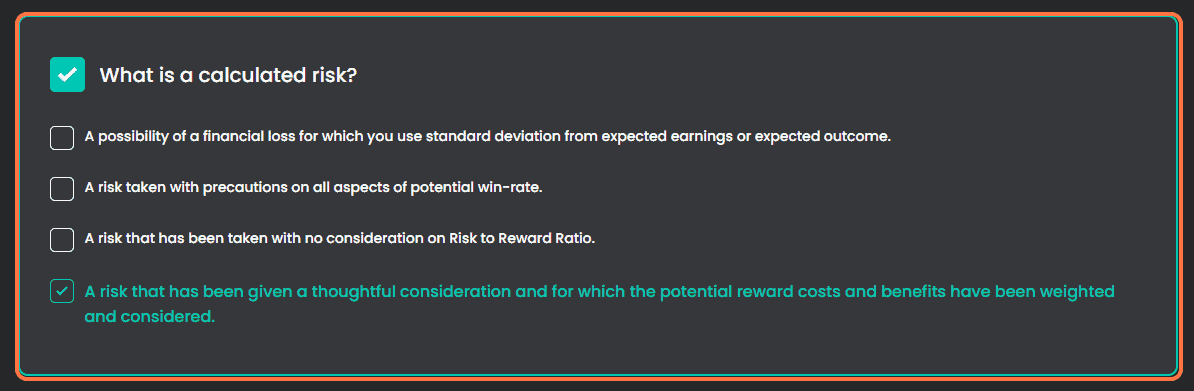

7. What is a calculated risk?

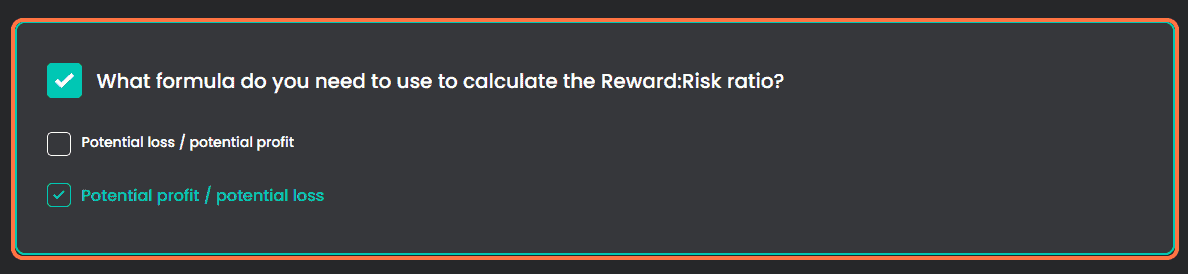

8. What formula do you need to use to calculate the Reward:Risk ratio?

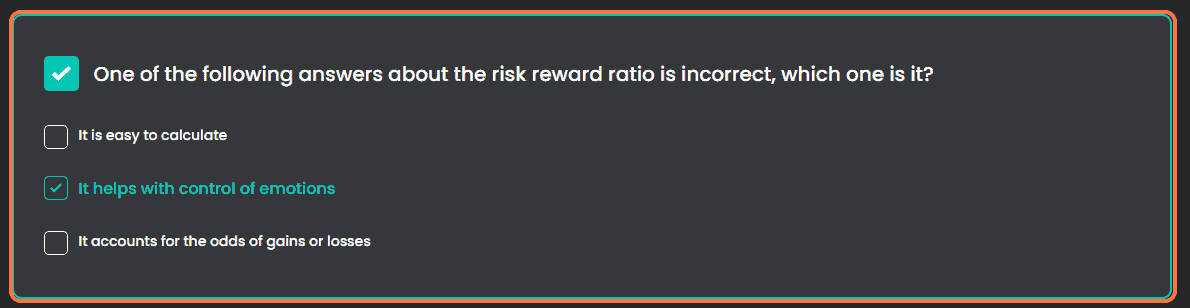

9. One of the following answers about the risk reward ratio is incorrect, which one is it?

03. Trading Plan

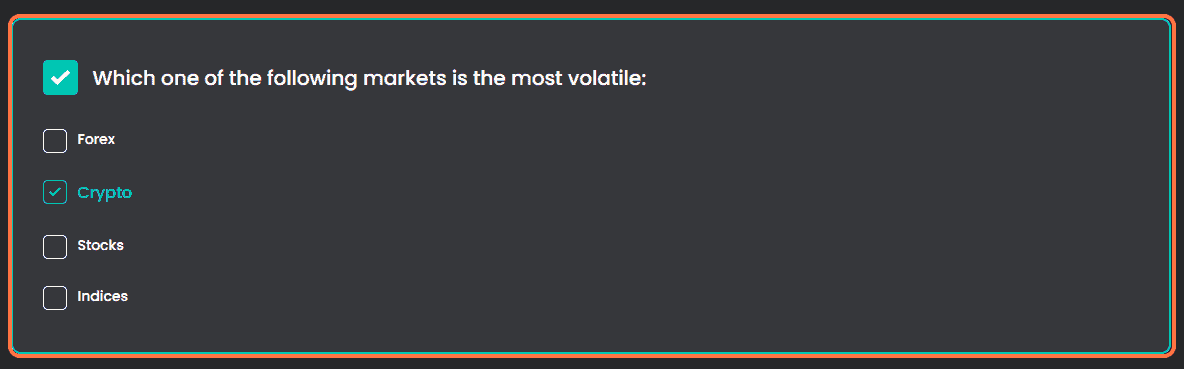

1. Which one of the following markets is the most volatile?

2. Which one of the following pairs is the most liquid pair?

3. Which one of the following market sessions are the least liquid?

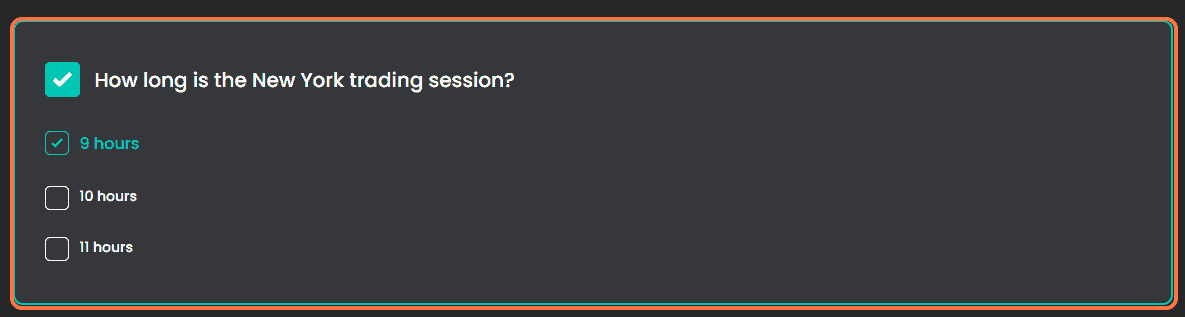

4. How long is the New York trading session?

5. Which of the following market conditions is better for trading?

6. When the market is making lower highs and lower lows, it’s in a …

7. Which type of traders usually trade on higher timeframes?

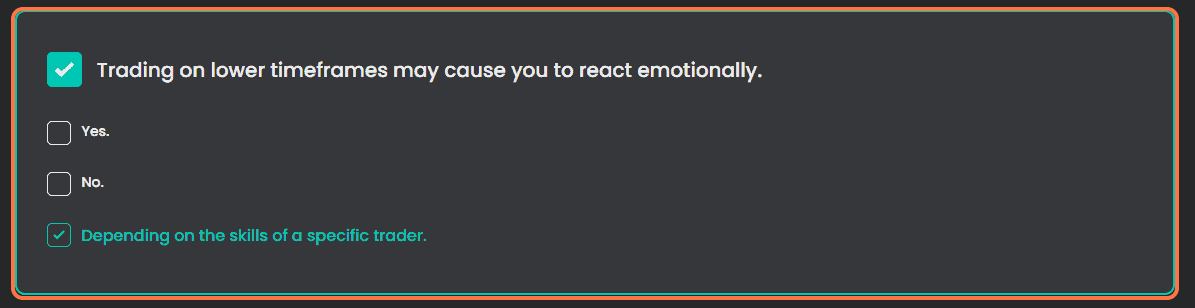

8. Trading on lower timeframes may cause you to react emotionally …

9. True or False? – You should always trade with money you can afford to lose …

10. The main reason to have Entry points which are well pre-defined is …?

11. SL/TP should be always set according to …?

II. Trading Platforms

01. MetaTrader 4 Guide

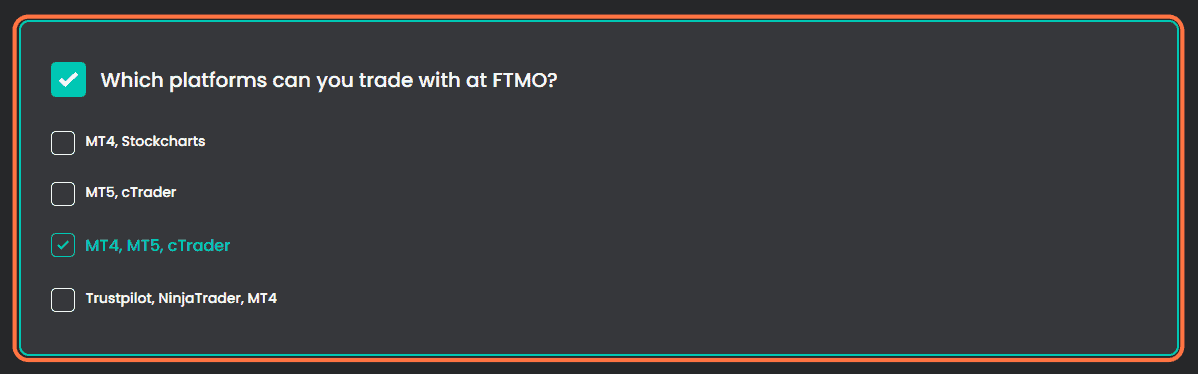

1. Which platforms can you trade with at FTMO?

2. Where can you find your login credentials for trading at FTMO?

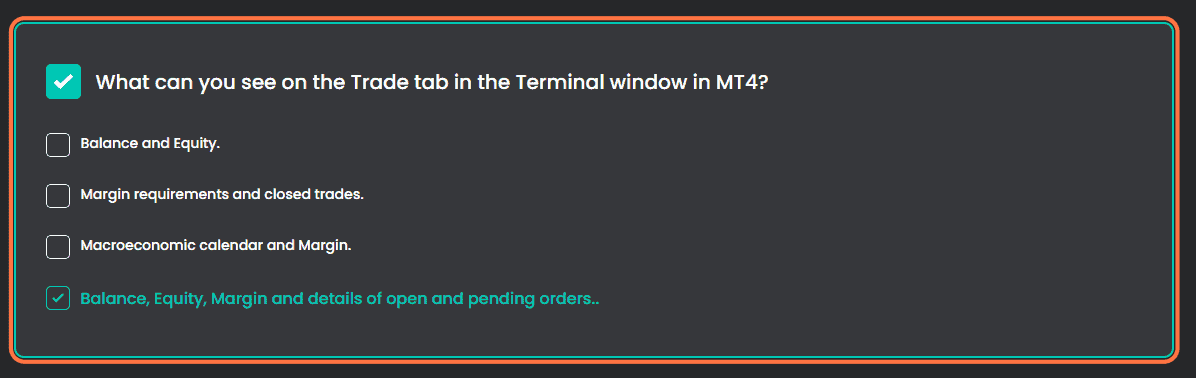

3. What can you see on the Trade tab in the Terminal window in MT4?

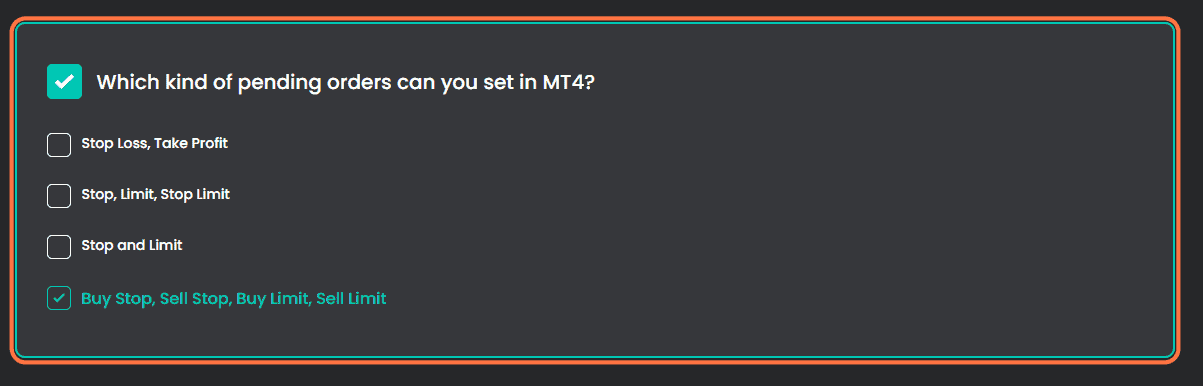

4. Which kind of pending orders can you set in MT4?

02. MetaTrader 5 Guide

1. What is the most significant difference in MT5 compared to MT4?

2. How can you modify the quotes in the MT5 mobile app?

3. Which kind of pending orders can you set in MT5?

03. cTrader Guider

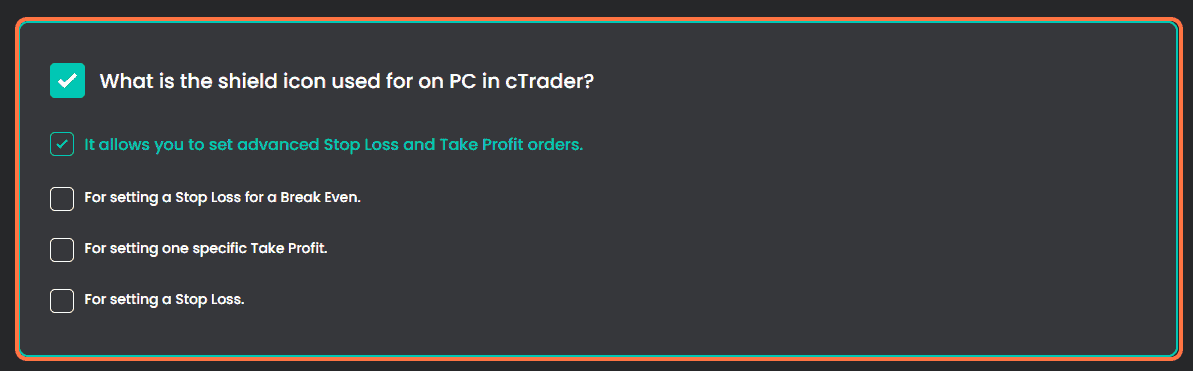

1. What is the shield icon used for on PC in cTrader?

2. Which chart types are available by clicking on the time period next to the symbol name in cTrader?

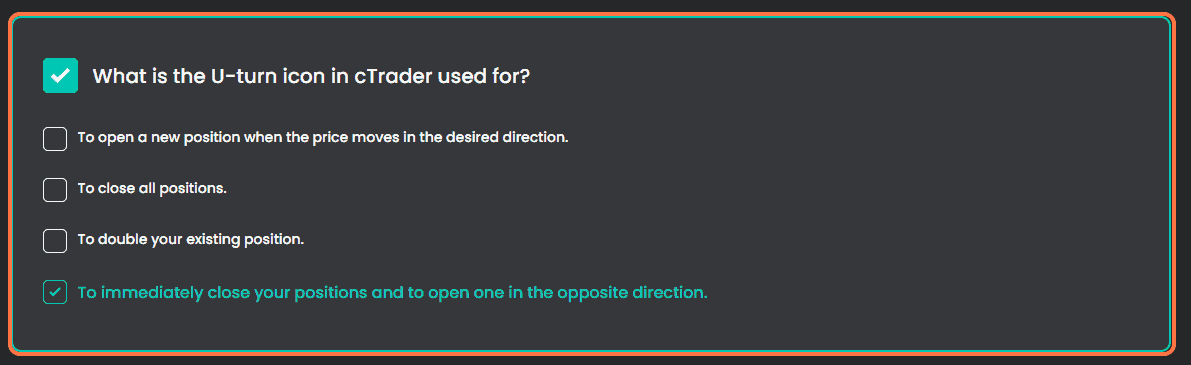

3. What is the U-turn icon in cTrader used for?

That’s the FTMO Academy Answers Part 3. Next here: Part 4.

Feel free to ask anything in comment below.

Thanks